Being a 'pro' at anything is something to be proud of. That means you are very talented. If you are an athlete, you would want to be a pro-athlete. When it comes to estate planning, it is not an advantage if you have retained and maintain a 'pro' status when it comes to procrastinating.

To say you never procrastinate, is a lie. Don't kid yourself. Everyone has fallen victim to the 'dark playground'. After all, the fact that you are reading this article means you are currently in the 'dark playground' and avoiding doing things that are actually on your 'to do list' (which I kindly appreciate and in this instance, I am more than happy to see that you are procrastinating)

“Stop being a ‘pro’crastinor and be ‘pro’active when it comes to your estate planning. There is no guarantee there will be a tomorrow, so prepare today.”

When it comes to estate planning, procrastinating should never be an option. It eventually causes family fighting and the chance of losing a portion of your estate to creditors.

Great example of how procrastinating can cause more problems than expected.

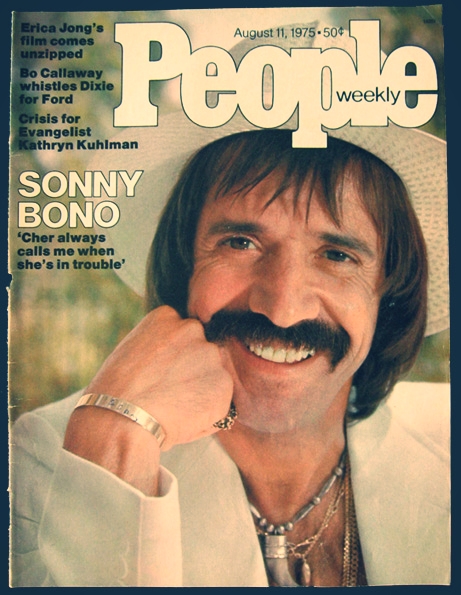

Sonny Bono, passed away at the age of 62 due to complications from injuries sustained in a skiing accident. At the time of his death, Bono passed away with no estate planning, not even a simple will. Fights ensued, due to the fact Bono had multiple marriages and children from each of those marriages. Even worse, at the time of his death, a secret love child surfaced wanting a piece of Bono's estate.

If Bono had not procrastinated and prepared his estate planning documents, he could have clearly stated who would and who would not receive from his estate (including a statement excluding any possible 'love children').

Stop being a 'pro'crastinor and be 'pro'active when it comes to your estate planning. There is no guarantee there will be a tomorrow, so prepare today.

If you live in Miami-Dade, Broward, or Palm Beach county contact an experienced estate-planning attorney at The Hershey Law Firm, in Fort Lauderdale, Florida, at (954) 303-9468 to discuss your estate planning needs. You can’t predict the future, but you can plan for it.